The First Advantage Debt Relief Experience

Debt can feel like an insurmountable mountain, casting a shadow over every aspect of your life. Many individuals find themselves trapped in a cycle of financial distress, struggling to make ends meet while drowning in unpaid bills and high-interest rates. However, solutions do exist, and one of the most promising options in the realm of debt relief is First Advantage Debt Relief. This innovative program is designed to provide individuals with the tools and resources necessary to regain control of their finances and pave the way for a brighter, debt-free future.

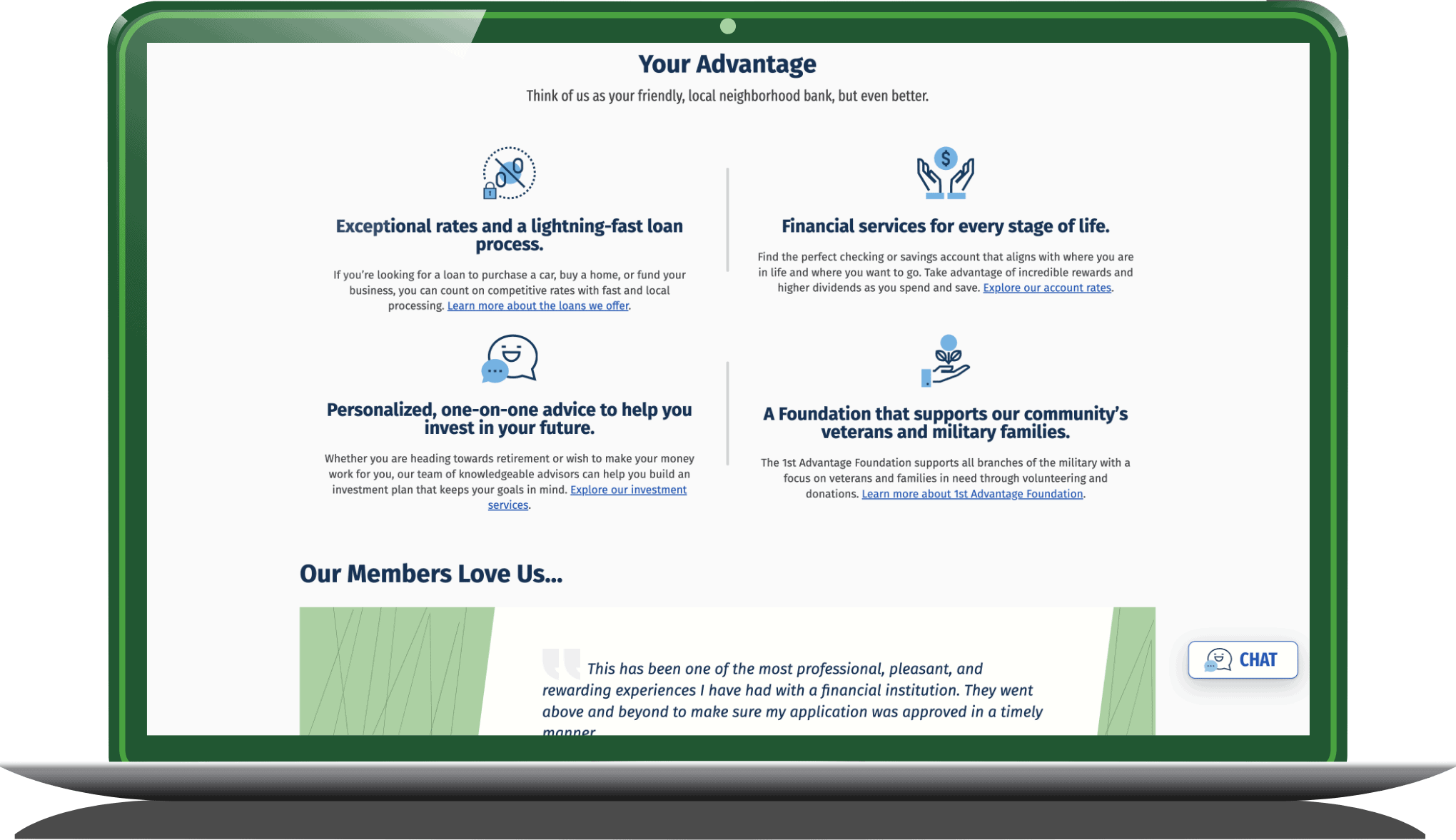

At First Advantage Debt Relief, the focus is not just on alleviating immediate financial burdens but on empowering clients to achieve long-term stability. By offering personalized plans tailored to each individual's unique financial situation, this organization helps clients navigate the complexities of debt relief, ensuring they can make informed decisions every step of the way. With a team of experienced professionals dedicated to supporting their clients, First Advantage offers a comprehensive approach that emphasizes education, negotiation, and strategic planning.

As the financial landscape continues to evolve, the need for effective debt relief solutions has never been greater. First Advantage Debt Relief stands out as a beacon of hope for those seeking assistance in overcoming their financial challenges. Through their commitment to transparency and client-focused service, they are transforming the debt relief experience, making it more accessible and effective for everyone. If you're ready to take the first step towards financial freedom, this might just be the solution you've been looking for.

What Is First Advantage Debt Relief?

First Advantage Debt Relief is a specialized service that aims to help individuals and families eliminate their debt through a structured program. This service provides a combination of financial advice, debt negotiation, and personalized repayment plans to assist clients in managing their financial obligations effectively.

How Does First Advantage Debt Relief Work?

The process of debt relief through First Advantage typically involves several key steps:

- Initial Consultation: Clients meet with financial advisors to evaluate their financial situation.

- Custom Plan Development: Based on the assessment, a personalized debt relief plan is created.

- Negotiation with Creditors: The team negotiates with creditors to reduce the total debt amount.

- Implementation: Clients follow the plan while receiving ongoing support and advice.

Who Can Benefit from First Advantage Debt Relief?

Individuals facing various forms of debt can benefit from this service. Common situations include:

- Credit card debt

- Medical bills

- Student loans

- Personal loans

What Are the Benefits of Choosing First Advantage Debt Relief?

Choosing First Advantage Debt Relief comes with numerous advantages, including:

- Personalized attention from experienced financial advisors.

- Potentially reduced debt amounts through effective negotiation.

- Improved credit scores over time as debts are paid off.

- Access to educational resources to better manage finances in the future.

Is First Advantage Debt Relief Right for You?

Determining whether First Advantage Debt Relief is suitable for your needs depends on several factors:

- Your total debt amount.

- Your ability to make monthly payments.

- Your long-term financial goals.

How to Get Started with First Advantage Debt Relief?

Getting started is simple and involves just a few steps:

What Do Clients Say About Their Experience with First Advantage Debt Relief?

Client testimonials often highlight the positive impacts of First Advantage Debt Relief:

"Thanks to First Advantage, I was able to negotiate my debts and finally breathe easy!"

"The support and guidance I received were invaluable on my journey to becoming debt-free."

Conclusion: Is First Advantage Debt Relief the Solution You Need?

For those grappling with financial difficulties, First Advantage Debt Relief offers a comprehensive, supportive approach to debt relief. With a focus on personalized service and client empowerment, this program can provide the tools and resources needed to regain financial control and achieve lasting stability. If you're ready to take charge of your financial future, consider reaching out to First Advantage Debt Relief today.

ncG1vNJzZmivp6x7s7HBnqOrmZ6YtbjFzmeaqKVfnLy0v8ipZKCkkaOwpoGOn6Crq6RirqXCwKermp%2BVYrGmrtNmqZ6kmZqzb7TTpqM%3D